Where are Mortgage Rates Headed Next?

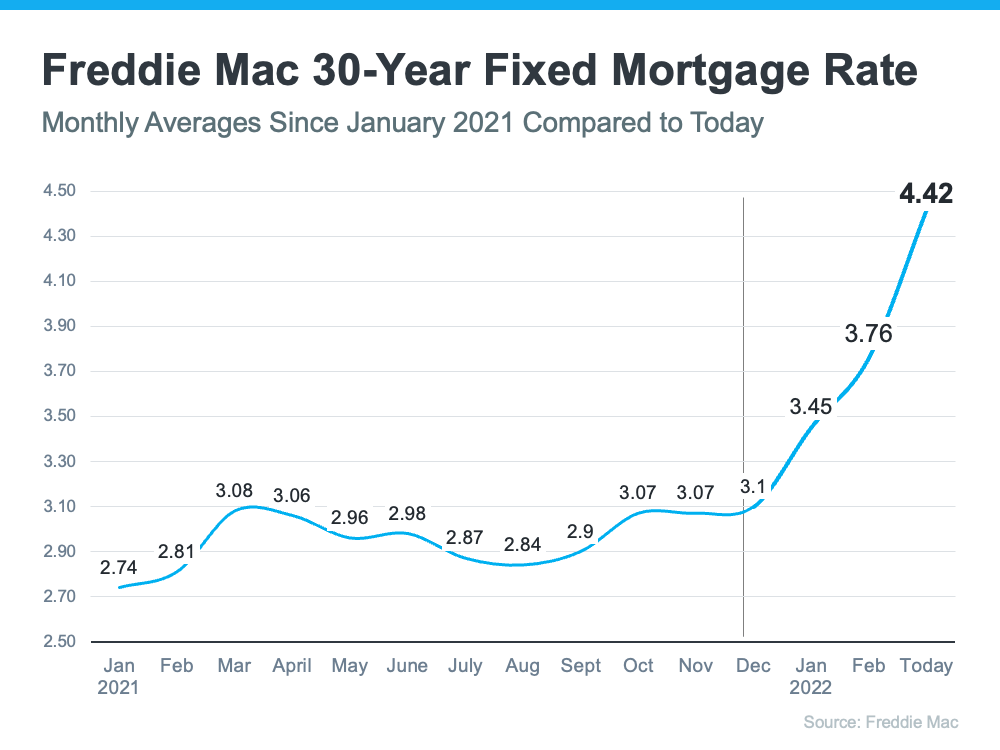

According to a

Primary Mortgage Market Survey from

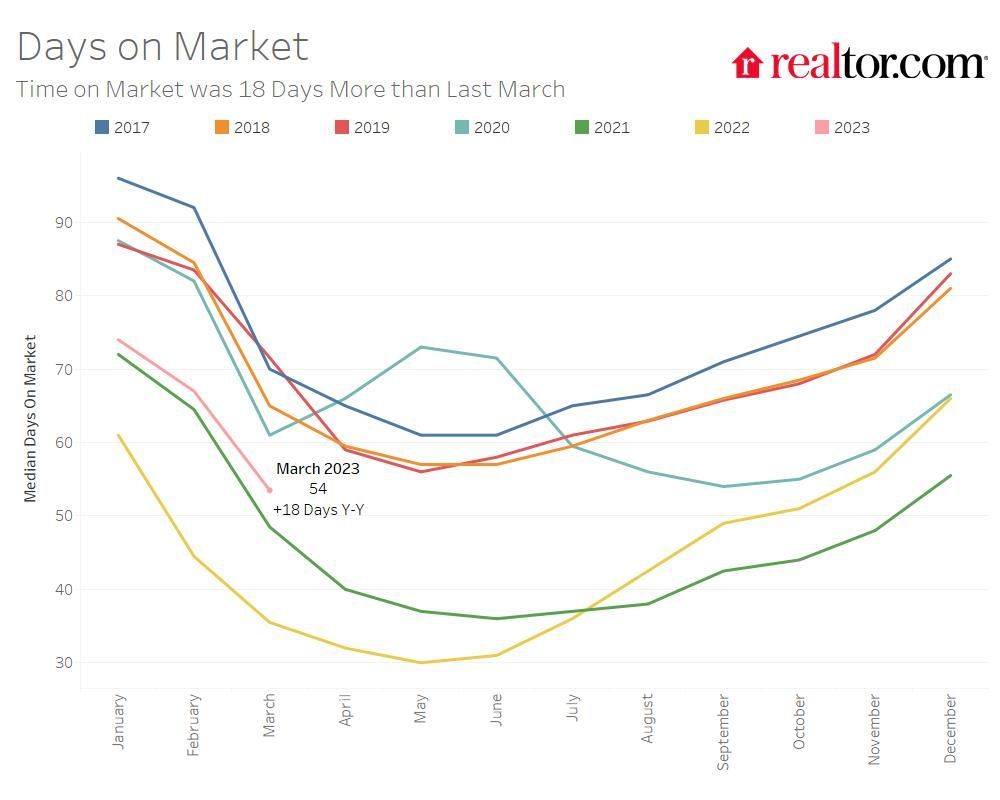

Freddie Mac, the average 30-year fixed-rate mortgage has increased by 1.2% (3.22% to 4.42%) since January of this year. Even from just a couple weeks ago, the rates have increased by more than a quarter of a point. The graph below represents how the mortgage rate remained somewhat steady in 2021 compared to how much is has increased this year.

Rates have been continuing to surpass projections made and will most likely continue to rise. According to Chief Economist at Freddie Mac, Sam Khater, “the 30-year fixed-rate mortgage increased by more than a quarter of a percent as mortgage rates across all loan types continued to move up. Rising inflation, escalating geopolitical uncertainty and the Federal Reserve’s actions are driving rates higher and weakening consumers’ purchasing power.”

Where are the mortgage rates headed now?

There was an article posted recently by Bankrate, that listed several opinions made by experts on where the mortgage rates are headed now. Here are some of their predictions:

- Greg McBride: “With inflation figures continuing to surprise to the upside, mortgage rates will remain above 4.0% on the 30-year fixed.”

- Nadia Evangelou- Senior Economist: “While higher short-term interest rates will push up mortgage rates, I expect some of this impact to be mitigated eventually through lower inflation. Thus, I expect the 30-year fixed mortgage rate to continue to rise, although we aren’t likely to see the big jumps that occurred over the past few weeks”

What do increasing mortgage rates mean if you are looking to build a home?

Building a home sooner rather than later would be beneficial because mortgage rates and the value of homes are going to continue to increase as the months go on. The longer you wait, the more money it is going to cost you. However, there may be a positive to building a home right now. Although you will be paying a higher price and a higher mortgage rate than you would have in the past, there is a long-term benefit of rising prices once you build.

For example, if you build a home for $500,000 and you put 10% down, you will be taking out a mortgage of $450,000. According to mortgagecalculator.net, at a 4.5% fixed mortgage rate, your monthly payment would be $2,280.08. This payment would not include insurance, taxes, and other fees based on the location are in.

Let’s put this mortgage payment into a new perspective based on the substantial growth in equity that comes with the escalation in home prices. Every quarter, Pulsenomics surveyed a panel of over 100 economists, regarding the future prices of homes in the United States. They released a Home Price Expectation Survey, that revealed an average of the experts’ forecasts calls for a 9% increase in home values in 2022. With that being said, if you were to build a home today for $500,000, it would be valued at $545,000 this time next year. This would cause equity in your home to increase.

Bottom Line

It is difficult to have to pay a higher price and a higher mortgage rate for a home. If you wait though, it will just cost you more in the long run. If you have the capability of building a home, now is the best time. Contact us today to begin building your dream home.

The article "What's Happening with Mortgage Rates and Where Will They Go from Here?" was originally posted on Keeping Current Matters website.

Contact Us